The smart Trick of Estate Planning Attorney That Nobody is Discussing

The smart Trick of Estate Planning Attorney That Nobody is Discussing

Blog Article

The Best Strategy To Use For Estate Planning Attorney

Table of ContentsEstate Planning Attorney Can Be Fun For AnyoneFacts About Estate Planning Attorney RevealedThe smart Trick of Estate Planning Attorney That Nobody is Talking AboutThe Definitive Guide to Estate Planning Attorney

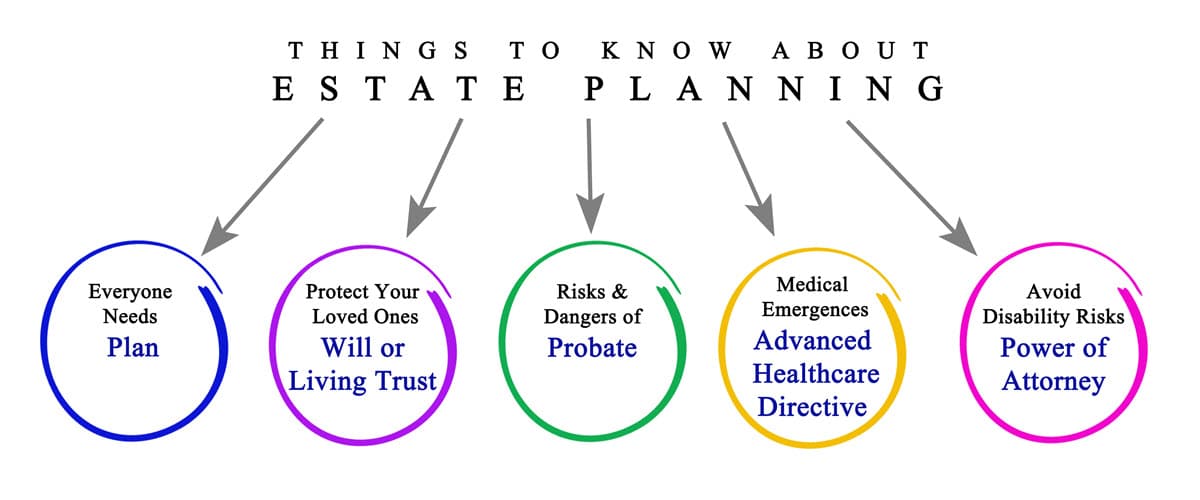

Estate planning is an activity plan you can use to establish what takes place to your properties and responsibilities while you live and after you pass away. A will, on the various other hand, is a legal record that details exactly how properties are dispersed, that cares for children and animals, and any type of other dreams after you pass away.

Insurance claims that are denied by the administrator can be taken to court where a probate judge will have the last say as to whether or not the insurance claim is valid.

The Facts About Estate Planning Attorney Uncovered

After the stock of the estate has been taken, the worth of possessions calculated, and taxes and financial obligation settled, the executor will certainly then look for authorization from the court to disperse whatever is left of the estate to the beneficiaries. Any type of inheritance tax that are pending will come due within 9 months of the date of fatality.

Each individual locations their assets in the trust and names somebody other than their spouse as the recipient. A-B depends on have ended up being much less popular as the inheritance tax exemption functions well for many estates. Grandparents might transfer possessions to an entity, such as a 529 plan, to support grandchildrens' education.

The 7-Minute Rule for Estate Planning Attorney

Estate coordinators can deal with the benefactor in order to reduce taxable income as a result of those contributions or formulate strategies that maximize the result of those donations. This is an additional approach that can be utilized to restrict death tax obligations. It entails a private securing the present worth, and therefore tax obligation, of their residential or commercial property, while connecting the value of future development of that capital to an additional person. This method entails freezing the worth of a possession at its worth on the date of transfer. Appropriately, the amount of prospective capital gain at fatality is additionally frozen, i loved this permitting the estate coordinator to approximate their prospective tax obligation upon fatality and better plan for the repayment of revenue tax obligations.

If enough insurance coverage proceeds are offered and the policies are appropriately structured, any type of earnings tax obligation on the deemed dispositions of possessions adhering to the death of an individual can be paid without resorting to the sale of possessions. Proceeds from life insurance policy that are gotten by the beneficiaries upon the fatality of the guaranteed are typically earnings tax-free.

There are specific records you'll need as component of the estate preparation procedure. Some of the most common ones include wills, powers of lawyer (POAs), guardianship designations, and living wills.

There is a misconception that estate preparation is only for high-net-worth people. Estate preparing makes it simpler for people to determine their wishes prior to and after they die.

The Best Guide To Estate Planning Attorney

You need to start preparing for your estate as quickly as you have any kind of measurable asset base. It's an ongoing procedure: as life proceeds, your estate strategy need to move to match your conditions, in accordance with your new goals. And maintain at it. Not doing your estate preparation can create undue financial concerns to get more enjoyed ones.

Estate planning is often taken a tool for the well-off. But that isn't the case. It can be a beneficial method for you to take care of your possessions and responsibilities before and after you die. Estate planning is also a wonderful means for you to lay out plans for the treatment of your minor youngsters and animals and to detail your long for your funeral service and favorite charities.

Applications need to be. Eligible applicants who pass the click here now exam will certainly be officially certified in August. If you're eligible to rest for the examination from a previous application, you may submit the short application. According to the guidelines, no qualification will last for a duration much longer than 5 years. Discover out when your recertification application schedules.

Report this page